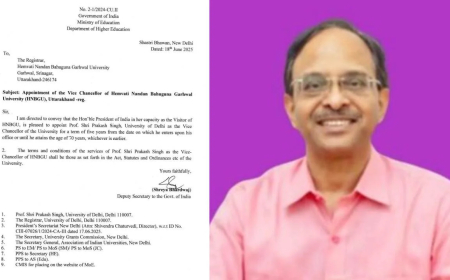

ITC Hotels Share Price in Focus as Stock Exits Sensex and Other Indices Amid Demerger Dynamics

ITC Hotels shares are under scrutiny as the stock is removed from key indices like the Sensex and Nifty 50, triggering an estimated ₹1,100 crore worth of passive selling amid its recent demerger from ITC Ltd.

ITC Hotels, the recently demerged entity of ITC Ltd, will no longer be part of the Sensex and other BSE indices starting February 5, 2025. This decision follows the stock's failure to hit the lower circuit by the cut-off time on February 4, as mandated by exchange regulations.

The Bombay Stock Exchange (BSE) confirmed the move in a notice, stating, “As ITCHOTELS did not hit the lower circuit till the cut-off time, the company will be dropped from all the BSE Indices effective prior to the open of trading on Wednesday, February 5, 2025.”

This development has significant implications for the stock, which was temporarily included in key indices for portfolio rebalancing by passive funds. Analysts estimate that the exclusion could trigger passive selling worth over ₹400 crore from index trackers linked to the Sensex and another ₹700 crore when the stock is removed from the NSE Nifty 50.

Market Reaction to the Demerger and Listing

ITC Hotels made its debut on Indian stock exchanges on January 29, 2025, at a listing price of ₹188 per share on the BSE and ₹180 on the NSE. However, the stock opened at a steep discount to its discovered price of ₹260 (BSE) and ₹270 (NSE), reflecting tepid investor sentiment. By the close of trading on February 4, the stock had fallen further, ending 4.16% lower at ₹164.65 apiece on the BSE.

The company’s market capitalization has also taken a hit, dropping from over ₹39,000 crore at listing to approximately ₹34,266 crore as of February 4. The decline underscores the challenges faced by newly listed entities, especially those spun off from larger conglomerates like ITC Ltd.

Strong Operational Performance Despite Challenges

Despite the market turbulence, ITC Hotels boasts robust operational metrics. The company has demonstrated consistent growth in key performance indicators such as Average Room Rate (ARR) and Revenue Per Available Room (RevPAR).

- ARR Growth : From ₹7,900 in FY19 to ₹12,000 in FY24—a 51.9% increase (CAGR of 8.7%).

- RevPAR Growth : From ₹5,200 to ₹8,200 in the same period—a 57.7% rise (CAGR of 9.5%).

In FY24, room sales contributed 52% to total revenue, while food and beverage accounted for 40%. Owned hotels, which make up 35% of the portfolio, reported a 20% YoY growth in ARR and an 18% YoY increase in RevPAR, with occupancy levels reaching 69%.

These figures highlight the company’s strong fundamentals and healthy return ratios, including a Return on Capital Employed (RoCE) of approximately 20%. Additionally, ITC Hotels operates with a net cash surplus and negligible debt, positioning it well for future expansion.

Ambitious Growth Plans Ahead

As one of India’s largest hotel chains, ITC Hotels currently manages 140 properties with around 13,000 operating keys. The company aims to expand its footprint to over 200 hotels and 18,000 keys by 2030. This ambitious target reflects confidence in the hospitality sector’s recovery post-pandemic and growing demand for premium accommodations.

Approximately 35% of ITC Hotels’ portfolio is owned, while the remaining 65% operates under management or franchise models. This diversified approach allows the company to scale efficiently while maintaining profitability.

Implications of Passive Selling

The removal of ITC Hotels from major indices is expected to weigh heavily on its share price in the short term. Passive funds tracking indices like the Sensex and Nifty 50 are likely to sell their holdings en masse, adding downward pressure on the stock.

Analysts caution that the ₹1,100 crore worth of anticipated selling could exacerbate volatility, particularly given the stock’s already weak performance since listing. Retail investors should exercise caution and monitor developments closely before making investment decisions.

Context of the Demerger

ITC Hotels was carved out of ITC Ltd through a demerger effective January 1, 2025, with a record date of January 6. Existing shareholders received one ITC Hotels share for every 10 ITC shares held. Post-demerger, ITC Ltd retained a 40% stake in the new entity, distributing the remaining 60% among shareholders.

The demerger aimed to unlock value by allowing ITC Hotels to operate independently and focus on its core hospitality business. While the move has strategic merit, the stock’s initial reception suggests that markets remain cautious about its prospects.